W-3 Software

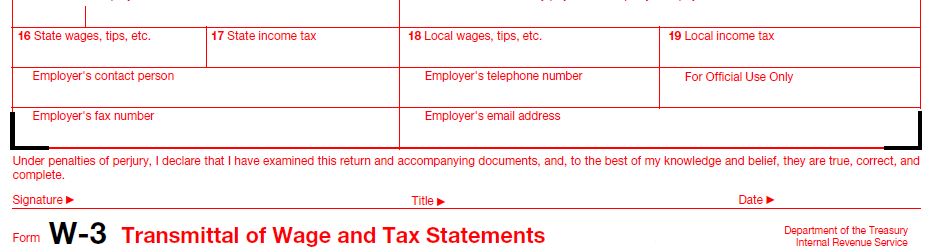

Transmittal of Wage and Tax Statements

Use the software today! Order online and the shopping cart will e-mail you instructions on how to activate the software.

IRS/SSA Form W-3 – Form W-3 is the Transmittal of Wage and Tax Statements. It is a transmittal summary that you send to the Social Security Administration (SSA) to show total earnings, Social Security wages, Medicare wages, and withholding for all employees in a year. You add up wages for all of your employees in each category using the W-2 forms to complete the W-3 form.It is only filed in conjunction with a Form W-2, Wage and Tax Statement.

A Form W-3 contains:

Information about the employer

Kind of payer

Kind of employer

Establishment number

Totals that you are submitting in the W-2

Contact information

A Form W-3 contains:

Information about the employer

Kind of payer

Kind of employer

Establishment number

Totals that you are submitting in the W-2

Contact information

Related Links…

W-2 Software – Wage and Tax Statement

W-2C Software – Corrected Wage and Tax Statement

W-3 Software – Transmittal of Wage and Tax Statements

W-3C Software – Transmittal of Corrected Wage and Tax

Related…

W-3 software, W3 software, W-3 Electronic Filing Software, W3 Electronic Filing Software, Transmittal of Wage and Tax Statement, IRS/SSA Form W-3, IRS/SSA Form W3, Accuwage